Elder Financial Exploitation

Elder abuse refers to any knowing, intentional, or negligent act by a caregiver or any other person that causes harm or a serious risk of harm to a vulnerable adult. Types of elder abuse include physical, emotional, sexual, financial exploitation, neglect and abandonment. The resources we’ve collected here focus on financial exploitation.

Elder financial exploration is the illegal or improper use of an incapacitated or vulnerable adult’s resources for another’s profit or advantage. Examples include forgery, misappropriation of cash or assets, abuse of joint accounts, and abuse of power of attorney. Elder financial exploitation is the third most frequent form of abuse (after neglect and emotional abuse) – recent statistics indicate that 30 to 40% of elder abuse involves some form of financial exploitation. And the problem is increasing as the number up elders rise.

Who are the victims of elder financial exploitation?

Key is vulnerability rather than age. Victims may have one or more physical and/or mental impairments. They tend to be isolated by circumstances or perpetrator. And being competent doesn’t eliminate vulnerability. The MetLife Study of Elder Financial Abuse (2011) found that elder females over age 70 who reside alone were likely victims. Women were nearly twice as likely to be victims of elder financial abuse as men. The study also found that many may suffer from more than one type of abuse.

Who are the perpetrators/abusers?

- Caregivers (may or may not be family)

- Friends & neighbors

- Business & Industry

- Strangers—telemarketers, robbers, burglars

- Professionals—accountants, lawyers, bankers, financial planners, guardians

- Relatives

Who are the perpetrators?

90% of elder abuse is perpetrated by family. Of that, 50% is by adult children and 20% is by spouses.

Abuse of Power of Attorney: Preventing and Addressing Elder Family Financial Exploitation

UWE Publication B-1368

January 2021

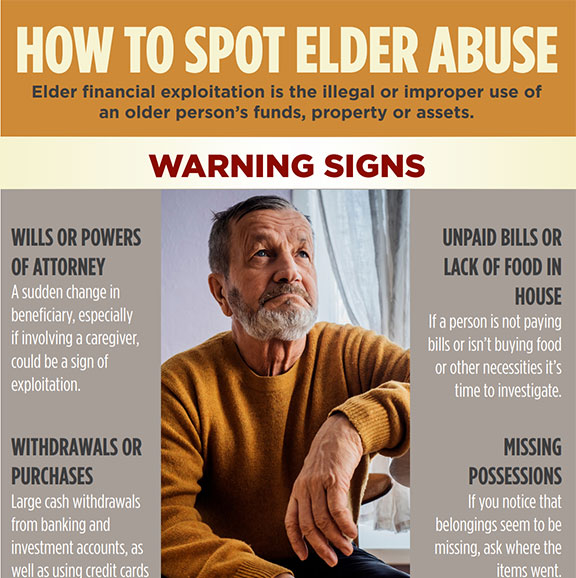

What are the warning signs of elder financial exploitation?

Behavior warning signs include

- Uncharacteristic change in routine appointments and services

- Unexplained or sudden financial problems, e.g. inability to pay bills

- Anxiety about personal finances

- Inaccurate or lack of knowledge about financial status

- Confusion about missing funds

- Shift to cash transactions w/o documentation

Other specific clues to financial exploitation include

- Numerous withdrawals

- A disparity between income and assets

- Missing belongings or property

- Being accompanied by a stranger

- A signature that looks forged, unusual or suspicious

- Out-of-sync check numbers

- A change in account beneficiaries

- An application for a credit card for the first time

- Credit card statements sent elsewhere

- Unprecedented transfer of assets to others

- Changed property titles, deeds or other documents

- Abrupt changes in a will, trust or power of attorney

- Refinanced mortgage

Elder financial exploitation is often underreported by the victims, perhaps because of shame or a desire not to cause problems. And it is not uniformly reported in national data collection or repository of reported cases since jurisdictions vary in how they describe and report the crime.

Resources for Victims and Family Members

- Elder Financial Exploitation Mandatory Reporting Laws by State - as of January 2019

- Resources on Elder Abuse/Elder Financial Exploitation - collected January 2020

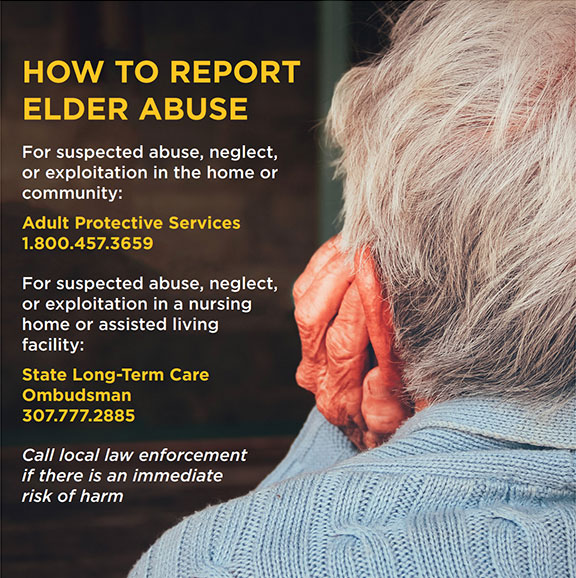

- County Adult Protective Services (APS): www.napsa-now.org/get-help/help-in-your-area/ Its mission is to ensure the safety & well-being of elders & dependent adults in a community setting.

- Suspected abuse or neglect in a long term care facility--contact a long term care ombudsman in your area: www.acl.gov/programs/protecting-rights-and-preventing-abuse/long-term-care-ombudsman-program

- Domestic Violence: www.thehotline.org/ or call the Confidential Hotline at 1-800-799-7233.

- City & county law enforcement. If the situation is serious, threatening, or dangerous, Call 911 or local police for immediate help.

- Private attorneys, especially elder attorneys

- Martindale-Hubbell's national website is a respected source of attorney reviews by peers & clients www.martindale.com/find-attorneys/

- State bar associations typically have attorney directories & may have some review information: hirealawyer.findlaw.com/choosing-the-right-lawyer/state-bar-associations.html

- Ageless Alliance www.agelessalliance.org

- American Bar Association, Commission on Law & Aging www.americanbar.org/groups/law_aging.html

- Consumer Financial Protection Bureau www.consumerfinance.gov/older-Americans/

- Department of Justice www.justice.gov, www.justice.gov/elderjustice/

- National Center of Elder Abuse https://ncea.acl.gov/

- Administration for Community Living www.acl.gov/aging-and-disability-in-america

- Administration on Aging for help planning for & finding eldercare, call 800-677-1116 or go to eldercare.acl.gov/Public/Index.aspx

- Office of the Comptroller of the Currency, Financial Literacy Resources www.occ.gov/topics/community-affairs/resource-directories/financial-literacy/index-financial-literacy.html#ElderFinancial

Resources for Raising Awareness

- Elder Financial Exploitation Mandatory Reporting Laws by State - as of January 2019

- Resources on Elder Abuse/Elder Financial Exploitation - collected January 2020

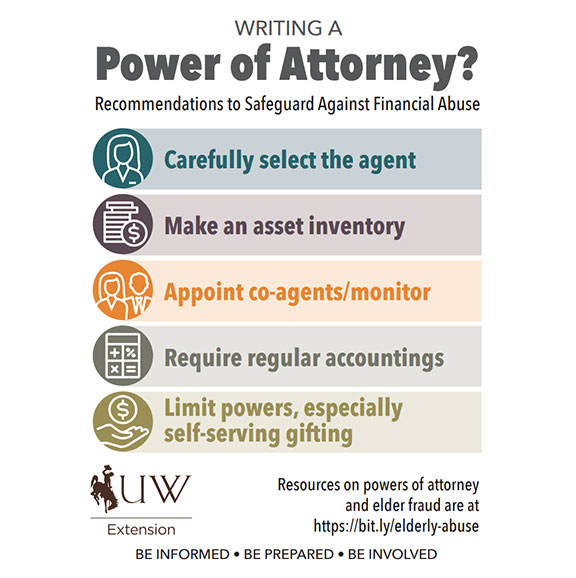

- Two-sided letter-sized placemat that can be used to raise awareness about avoiding power of attorney abuse

Fliers

Download and print the following fliers.

Ads

Download and use the following advertisements.

The University of Wyoming is part of a multi-state research team that is trying to understand the risk factors

of elder financial exploitation (2018) and would appreciate your input. www.uwyo.edu/fcs/confidential-survey Outputs so far include these article:

The University of Wyoming is part of a multi-state research team that is trying to understand the risk factors

of elder financial exploitation (2018) and would appreciate your input. www.uwyo.edu/fcs/confidential-survey Outputs so far include these article:

- Bernard A. Steinman , Virginia B. Vincenti & Sukyung Yoon (2020). Family dynamics and their association with elder family financial exploitation in families with appointed powers of attorney, Journal of Elder Abuse & Neglect, 32:5, 453-470, DOI: 10.1080/08946566.2020.1823290

- Teaster, P. B., Vincenti, V., Betz-Hamilton, A., Bolkan, C. and Jasper, C. (2019). Themes from Elder Financial Exploitation by Family Member Powers of Attorney. In Gender, Sexual Identity, and Families: The Personal Is Political. Co-editors: Lyness, K. & Fischer, J. (Monograph, vol. 6). https://quod.lib.umich.edu/g/groves/9453087.0005.001

- Betz-Hamilton, A.E., & Vincenti, V. B. (2018). Risk factors within families associated with elder financial exploitation (EFE) by relatives with powers of attorney (POA). Journal of Family and Consumer Sciences, 110(1), 19-27. http://dx.doi.org/10.14307/JFCS110.1.19

- Vincenti, V. B. (2014). Durable Power of Attorney. Volume 1. Encyclopedia of Consumer Safety and Protection. Santa Barbara: ABC-CLIO, Inc. 338-342.

They found that elder risk factors include:

- Lack of knowledge & experience with financial management

- Past abuse/financial exploitation &/or experiences of domination

- Depression (Lichtenberg, 2016)

- Susceptibility to flattery & other means of undue influence

- Lack of adequate planning for late-life dependency

Perpetrator risk factors include:

- Addictive behaviors (e.g. drugs, shopping)

- Relationship problems

- Lack of empathy

- Pattern of blaming others, avoiding responsibility for own actions

- Controlling/manipulative behaviors

- Lying or telling half truths

- Ageist attitude, devaluing older people

- Impulsiveness or self-control problems

- Lack of clearly defined goals or self-centered goals

- Competitive materialistic/money values

- Self-esteem tied to possessions, prestige, status, public image

- Money management problems, financial instability

- Financial entitlement attitude possibly based on sense of earlier unfair treatment

Family risk factors include:

- Parenting can contribute to risk or protective behaviors when children & later as

adults

- Enabling of irresponsible behaviors

- Inappropriately giving children power, responsibility & control of decisions they aren’t developmentally ready for

- Favoritism

- Abuse and violence in family relationships

- Additive behaviors creating family stress