Select from the following FAQ topics

We are open from 8:00 am to 5:00 pm (Mountain Time) Monday through Friday during the academic year and from 7:30 am to 4:30 pm during the summer. For more information please refer to our Contact Us page.

We accept drop-ins during normal business hours, but students and families are always welcome to book a virtual or in-person meeting at a time that works best for you!

Cost of Attendance (COA) is not a bill but is an estimate of school-related expenses a full-time student can expect to have for an academic year. COA includes direct expenses (those billed by UW), as well as indirect expenses, and it considers a student’s residency status, living arrangements and, in some cases, the student’s major. Be sure to consider COA, as well as any financial aid you have been offered, to determine what your out-of-pocket expenses might be.

Yes. Students can attend two or more institutions and combine credit hours by completing a consortium agreement. Using a consortium agreement can help you maintain full-time enrollment status for financial aid purposes. Some rules apply, so be sure to review the consortium agreement process. Please note that you can only receive federal aid or the Hathaway Scholarship (if eligible) from only one institution.

Once your first semester starts, or you turn 18 years of age, the Federal Educational Rights and Privacy Act (FERPA) prohibits us from discussing any of your specific financial matters with anyone but you without your written permission. Please visit our office to obtain the FERPA release form and complete it, or you may download it. Completed forms can be turned into our office with proof of ID. You may fax the form to us (307-766-3800) but must still provide proof of ID.

Another option would be to create an authorized user account for family members, or others within your support network, to give them access to your billing information. This also allows us to discuss your financial aid with them if they call, email, or stop by our office. If you have Authorized Users, you won’t also have to complete a separate FERPA release form!

There could be a variety of reasons, depending upon what type of financial aid it is. The best thing is to call our office so we can help troubleshoot the problem and see if you still have some outstanding documents or requirements holding up your aid.

Authorized financial aid will be disbursed towards your university-billed charges.

- Fall and Spring semesters disbursement occurs the evening following the end of the Drop Period. For example, if Drop Period ends at midnight on Wednesday, financial aid will disburse Thursday evening. Please see the semester scheduleas maintained by the Registrar's office.

- Summer semester disbursement occurs based upon the type of aid: Federal aid will disburse on the first day of your first class. All other aid will disburse on the first day of the summer semester.

Hint: You can always access this information in WyoRecords. On your Offer tab, select the aid year in question, and then click the “Payment Schedule” button in the upper right corner. That will provide a specific disbursement date for each semester!

Actually Student Financial Services handles questions regarding the following: Account balances, Payment dates and payment plans, status of refunds, tax form 1098-T, etc. They may be contacted via phone at (307) 766-6233, email at sfs@uwyo.edu, or they are located next door to our office in Knight Hall Room 172.

That is handled by UW’s Office of the Registrar, and they have detailed instructions on the process.

Federal aid, including grants and loans, can be applied towards the educational costs associated with any type of study abroad program.

Students who are receiving renewing institutional scholarships, including Commitments, must be enrolled in a UW 4001 level study abroad course (an exchange program), with tuition billed by UW, for your scholarship to disburse. If you enroll in a non-exchange study abroad program, your scholarship will not disburse but will count towards your maximum number of semesters of use.

Our office welcomes feedback from the UW Community (students, families, faculty, and staff). Please direct all concerns to our office for prompt resolution. If your need is not satisfied at this level, please complete this survey.

You may also schedule an appointment with our Director for final resolution.

That process is handled by UW’s Office of the Registrar, and you can learn more about the process and requirements. We urge you to meet with a financial aid advisor about potential impacts to your financial aid if you are successful at petitioning.

If you have been awarded a renewing non-resident Commitment or Award, and your residency status changes within your first year, students will be switched to a renewing resident Commitment at the appropriate level. If your residency status changes beyond your first year, your non-resident Commitment or Award will not be replaced.

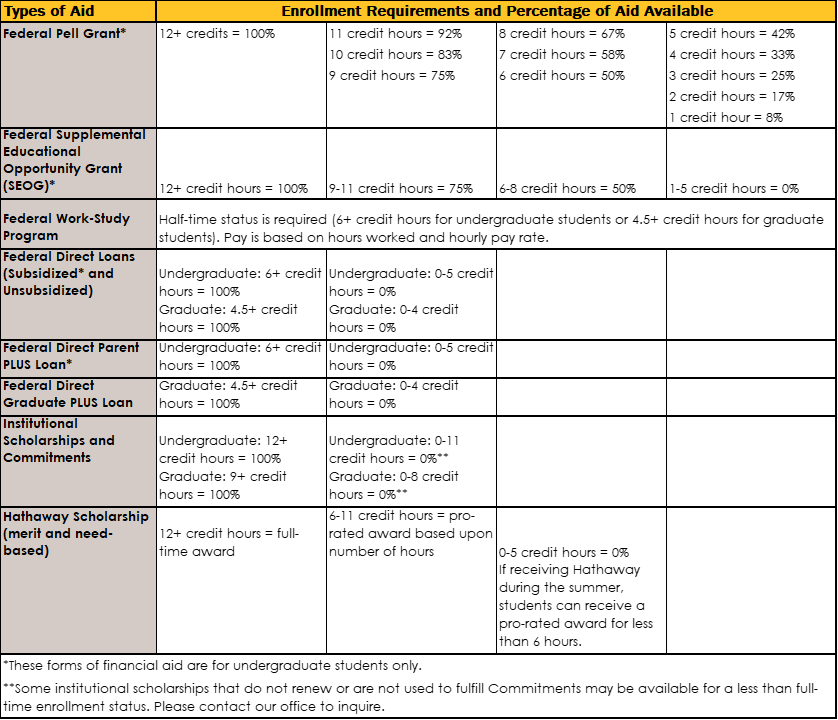

Some financial aid requires certain enrollment levels to remain eligible to receive funds. We always urge students to contact our office before making any decisions about withdrawing from courses or changing your enrollment status in any way so you understand the potential impact to your current and future financial aid before making the decision.

We understand sometimes there may be a need to withdraw from either one class or from all of them. Withdrawing may impact your financial aid and some funds may need to be returned. We strongly encourage you to read our Federal Return of Funds Policy before you withdraw and meet with a financial aid advisor to make sure you are informed before you make any decisions that could impact your financial aid.

We also suggest you review renewing eligibility requirements for your financial aid, including Satisfactory Academic Progress for federal aid and requirements for renewing scholarships.

If you enroll in courses at both the undergraduate and graduate levels in any semester, that may affect your eligibility to receive some types of financial aid, including scholarships. You should contact our office immediately to determine any impact.

The first step is to apply for admission to UW and submit your transcript and test scores (if applicable). Students are then reviewed for renewing scholarship eligibility and awarded, if you qualify.

To apply for federal or need-based aid at UW you need to complete the Free Application for Federal Student Aid (FAFSA). Certain types of aid, including loans, do require additional paperwork AFTER you have been awarded that aid. More information can be found on our Applying for Financial Aid page.

The most important thing to know is the earlier the better! February 1st our priority date for the upcoming academic year aid, so this is the date that we recommend you complete the FAFSA by so you have the best chance for some funding that is limited each year. But if that timeline doesn’t work for you, it’s okay! Each FAFSA is open for a 21-month cycle, so you can apply up through June 30th of an aid year. Example: for the 2025-2026 FAFSA, it will be opened through June 30, 2026.

Yes! The FAFSA is free to complete each year, but many families mistakenly think they don’t qualify for aid. In the end, they might prevent themselves from receiving financial aid because they fail to apply for it. In addition, there are a few sources of aid, such as unsubsidized and PLUS loans, that are available to students regardless of financial need.

Yes! You must complete and submit a FAFSA at studentaid.gov every year because each form uses a different tax year.

Students are required to accept or decline the Federal Direct Loans that we offer based upon your FAFSA results. Once accepted, the Office of Scholarships & Financial Aid must process the loan with the U.S. Department of Education which normally takes 2-3 business days but can take longer. If you have accepted a loan and it has still not paid within that time period, you may be missing information. Please contact our office for assistance.

Check your financial aid status often by logging into your student account in WyoRecords: Navigate to WyoWeb > WyoRecords > Students and log in. From your Checklist, select the appropriate Financial Aid Year Requirements (example: Financial Aid Year 2025-2026 Requirements) and look for anything in the Outstanding Requirements section.

You should also check your campus email frequently throughout the year for correspondence from our office.

Initial eligibility for renewing scholarships will be determined at the time of your admission to UW. Each year we roll those scholarships to the next academic year in early December, and then determine after spring grades are posted if you have maintained ongoing eligibility for them.

For federal aid, we won’t start packaging for the next academic year until early February. If you are admitted to UW beginning in spring semester, we normally package in early January, but you can always check with us before to see if your requirements are met, and we can package earlier for you.

For any FAFSA received after the initial packaging begins in February, the packaging process will occur daily during the week, as long as there are no outstanding requirements.

No, please do not submit income tax forms unless we specifically ask for them on WyoWeb.

Occasionally our office is required to check the accuracy of income reported on the FAFSA. Our Verification page provides more details about this.

Once you have enrolled in a summer course in WyoRecords, you will see a pop-up message reminding you to complete the FAFSA, complete the Summer Financial Aid Application (the link is provided), and to enroll in at least 6 credit hours for summer semester in order to qualify for federal aid. Once you have completed those three requirements, you will be packaged for federal aid in April if you are eligible.

There are some scholarships available for summer semester that will require an application in WyoScholarships.

Log into WyoRecords > Students at wyoweb.uwyo.edu.

- On the left side of the screen, select the applicable aid year link (Financial Aid Year 20xx-20xx Awards) link under the Checklist to accept or decline aid. Access the corresponding Requirements link for outstanding financial aid requirements.

- On the Offer tab, scroll past the Cost of Attendance section (but we urge you to review it!) to review what aid has been offered to you. Some types will have been accepted on your behalf to save you a step (e.g., a Pell Grant).

- When we open the aid acceptance functionality (usually in March), you will be able follow the Offered link under the Take Action column and follow the prompts to accept or decline.

Remember that when you accept aid, it will disburse (pay out) split equally between fall and spring semesters. The amount will also be slightly reduced by the Department of Education’s nominal origination fee.

The Free Application for Federal Student Aid (FAFSA) is the application for all federal aid programs, and it also determines if you qualify for any institutional or state need-based aid. Be sure to indicate the University of Wyoming’s school code (003932) on the application so we receive your information from the U.S. Department of Education.

No, we do not require students to complete the FAFSA, but keep in mind that FAFSA results are the only way we can determine a student’s eligibility for some financial aid, including grants and some scholarships.

FAFSA also needs to be completed every year since it uses a new tax year each time. The form opens on October 1 each year and uses the prior-prior tax year. For example: The 2025-2026 FAFSA uses the 2023 tax year. If this does not reflect your current situation, you can submit an appeal: See the “What if the FAFSA does not reflect my present situation?” question below.

You can create your FSA ID and complete the FAFSA form on studentaid.gov.

The U.S. Department of Education have specific questions that determine your dependency status for the FAFSA. They include questions about age, marital status, level in school, veteran status, dependent children, and special circumstances. If you feel that you should be considered an independent student, you may obtain the dependency appeal guidelines from our office. For more information see the Unusual Circumstances appeal forms.

The Department of Education has provided a flowchart to help you determine who your FAFSA contributor(s) will be.

Dependent students:

- In general, all dependent students, even those who do not live with their parents, must provide their parent’s information on the FAFSA.

- If your legal parents (biological or adoptive) are married to each other, or are not married to each other and live together, you should report information about both of them on your FAFSA.

- If you have no contact with your parents and don’t know where they live, or you’ve left home due to an abusive situation, select “Yes” to the “Do unusual circumstances prevent the student from contacting their parents or would contacting their parents pose a risk to the student?” question on the FAFSA. You will be considered provisionally independent. You should contact our office to find out what supporting documentation you will need to submit.

Independent students:

- The spouse of an Independent student who is married may need to be a contributor on the FAFSA, depending upon how taxes were filed. If taxes were submitted as Married/Filing Jointly, the spouse does not need to be a contributor. If the tax filing status was Married/Filing Separately, the spouse will be a required contributor who must provide consent.

Some of the most common reasons a contributor may be asked to manually enter their financial information on the FAFSA include:

- The contributor’s marital status has changed since filing their Internal Revenue Service (IRS) tax return for the applicable tax year (e.g., parents filed a joint tax return but are separated, divorced, or remarried when filing the FAFSA).

- The contributor filed taxes in a U.S. territory (Puerto Rico, Guam, American Samoa, U.S. Virgin Islands, Northern Mariana Islands), commonwealth, or foreign country.

- The contributor indicates on the online FAFSA that they have not filed a tax return but plan to.

- The contributor is a victim of IRS tax-related identity theft.

- The contributor's identifiers do not match IRS records.

- The transfer of FTI was incomplete.

- The IRS was unable to confirm tax return data.

- IRS data is unavailable for an IRS system-related outage at the time the FAFSA is being completed.

Yes. You can make allowable corrections to the FAFSA by returning to studentaid.gov and submitting your corrections electronically. Before doing so, we urge you to check with our office to determine if those changes are allowable or if they would revise the aid you originally qualified for.

The number of people in your household (or your parent’s household) will align with the number of dependents on your U.S. tax return (or your parent’s tax return), and that information will transfer directly from the IRS. If this number changes after filing the tax return, you can indicate this update directly on your FAFSA.

There is an appeal form that can be completed to request a review of the amount of aid awarded or to update us with your current situation. For more information see the Change of Circumstance appeal form.

As a student, you will accept your Federal Direct Loans on your student account in WyoRecords. Navigate to WyoWeb > WyoRecords > Students and log in. From your Checklist, select the appropriate Financial Aid Year Awards (example: Financial Aid Year 20xx-20xx Awards). In the Loans section of the Offer tab, you can accept, reduce, or decline any loan that have been offered. Students who are first-time borrowers will need to complete Loan Entrance Counseling and a Master Promissory Note on studentaid.gov before their loans can be disbursed by our office.

Parent PLUS loans cannot be accepted in WyoRecords. To apply for, and accept, a Parent PLUS loan, a parent must complete a loan application and a Master Promissory Note on studentaid.gov.

It takes about 3 to 5 business days once you’ve submitted loan requirements for us to receive confirmation from the Department of Education of their completed status.

If the academic year hasn’t expired following summer semester, we can re-offer the loan. You need to request this in writing by emailing finaid@uwyo.edu and be sure to include your W-number.

Repayment on most Federal Direct Loans begins when you graduate, leave college, or drop below half-time enrollment. Repayment on PLUS loans, however, begins when the loan is fully disbursed.

All Federal Direct Loans have a loan servicer that handles billing and other services. You can find your loan servicer by visiting studentaid.gov. Once you have identified your servicer, visit their website to research payment options or to make a loan payment. For private loans, contact your lender about repayment details.

To be eligible for Work-Study, you must:

- Be an undergraduate or graduate student.

- Submit the Free Application for Federal Student Aid (FAFSA) each year and have financial need as determined by the FAFSA.

- Be enrolled in at least half-time status (6 credit hours for undergraduate students or 4.5 credit hours for graduate students).

- Due to limited funding, not all students who are eligible will receive a Work-Study offer. Awards are generally restricted to applicants who complete the FAFSA by February 1 of any given year.

- Finally, it is the student’s responsibility, if initially awarded a Work-Study offer, to apply for and start working in a Work-Study position before funds will pay out.

If you have been awarded a Work-Study offer, you can review and apply for positions through the Human Resources website. Work-Study positions will start posting on July 1 each year.

Students can be considered for a Work-Study award by completing our waitlist survey form. If you completed the FAFSA and demonstrate financial need, and if funding is available, we will begin awarding students from the waitlist no sooner than the 4th week of the semester (fall/spring). You will be contacted through your campus email if you qualify and if funding is available for a late Work-Study offer.

If you are not awarded Work-Study, but still want to work part-time on campus, you can apply for non Work-Study job opportunities.

To be eligible for a Pell Grant, you must:

- Be an undergraduate student.

- Submit the Free Application for Federal Student Aid (FAFSA) each year and have financial need as determined by the FAFSA.

- Be enrolled in at least 6 credit hours (part-time enrollment). In the summer, you can receive a Pell Grant if you are enrolled in less than 6 credit hours.

- Still have remaining Pell Grant edibility (Lifetime Eligibility Used, or LEU).

There are three Title IV Authorizations that students should complete. These can be revised at any time, if you choose to.

- Title IV Charges Authorization – Federal financial aid will always be paid against standard charges that are tuition, fees, housing, and dining charges. But, should you have any excess federal financial aid remaining after your standard charges are paid, authorizing this requirement would let some of that extra aid go to pay non-standard charges, which could be student health charges, bookstore charges, parking fees, etc. We usually suggest that students authorize this requirement.

- Prior Year Authorization – Should you ever have prior year non-standard charges, authorizing this requirement would allow UW to use federal financial aid for the current year to pay those charges off, as long as they total less than $200. We usually suggest that students authorize this requirement.

- Hold Title IV Credit Balances Authorization – This requirement basically is a choice between who holds and controls any excess federal financial aid you may have in any semester. If you authorize it, UW would hold those excess funds and apply them to your account in a future semester. Keep in mind, however, that UW can only hold those through the current financial aid year, so they won’t continue to roll forward from year-to-year. Declining this requirement will result in any excess federal financial aid being processed as a refund and provided to you the student to hold and manage. We usually suggest that students decline this requirement.

The University of Wyoming is proud to offer a variety of renewing scholarship opportunities for new first-time and transfer students. These opportunities are based on your academic achievements at the time of admission to UW. See our Scholarship page for more information.

Continuing students who do not qualify for a renewing scholarship are strongly encouraged to complete the General Application in the WyoScholarships system each year, and then your student data will help determine if there are any scholarships you can receive.

Yes. All incoming students need to confirm their enrollment by certain dates to retain any renewing Commitment or scholarship that has been awarded:

- Fall Semester: confirm by May 1, at 11:59 pm MT (new first-time students) or by August 1, at 11:59 pm MT (new transfer students)

- Spring Semester: confirm by January 5, at 11:59 pm MT (both new first-time students and transfer students)

- Commitments will not be awarded after these dates without a successful appeal.

Scholarships that require an application within the WyoScholarships system normally open November 15 and close on March 15. Those scholarships won't be awarded until the next academic year. Example: Those that closed on March 15, 2025 were for academic year 2026-2027.

Summer enrollment prior to attending the fall semester at UW does not impact eligibility as long as your official admission record is documented with fall semester as your admittance term.

New First-Time Students: When you reapply to UW after attending another school, you will be considered a transfer student. That will make you ineligible for the original renewing Commitment or scholarship, but we will consider you for a Transfer Commitment using your post high school transfer credit hours and GPA.

Transfer Students: If you choose to reapply and attend UW in the future, we will review your updated transfer GPA to reevaluate if you are still eligible for any renewing Commitment or scholarship.

UW merit Commitments and scholarships for new first-time and transfer students are determined as part of the admission application process. If you submit a final transcript (high school or transfer) and/or new test scores (ACT or SAT, for new first-time only) by the first day of class of your first semester, we will review to determine if you qualify for a higher level.

If you want us to consider your high school weighted GPA, you will need to request that by completing an Initial Eligibility Scholarship Appeal form. Be sure to submit before the deadline noted on that form.

Renewing Commitment and scholarship levels will not be increased for students after they start receiving the scholarship.

Because the Commitment is just a pledge of scholarship support, there is no actual money attached to it. So, each year we will fulfill it with actual scholarships for at least the amount of the Commitment. Don't be alarmed if you receive completed different fulfilling scholarships each year!

If you are eligible to receive a renewing Commitment, more than likely that scholarship will be used to fulfill your Commitment. You may not be seeing it yet because our office controls when those scholarships are released each year, usually during the month of July.

See our External Scholarships page for instructions. There is also a form on that page that we strongly encourage external donors to use when submitting payments.

All renewing Commitments and scholarships, including the Hathaway scholarship for eligible resident students, require continuous full-time enrollment in both fall and spring semesters at UW.

Students can request to defer their Commitment of scholarship for religious service or military service only, after providing appropriate documentation to our office.

There is a separate FAQ page specific to the Hathaway Scholarship.